Mira Mesa shopping center anchored by Home Depot sells for $99M - The San Diego Union-Tribune

|

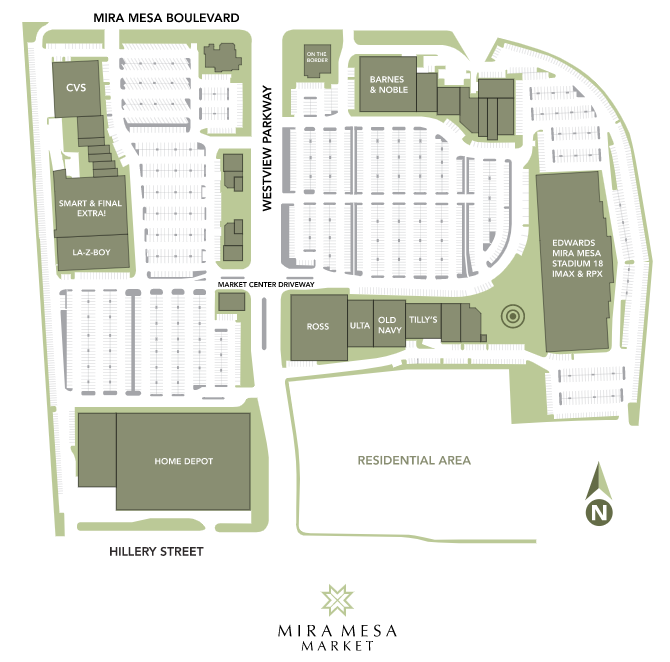

| Mira Mesa Market West is the left half of the large, outdoor shopping center known as Mira Mesa Market Center, south of Mira Mesa Boulevard west of Westview Parkway near Interstate 15. |

Summary

Decron Properties, a Los Angeles-based real estate firm, recently purchased the Mira Mesa Market West shopping center in San Diego from Stockbridge Capital Group for $99 million. The off-market transaction included the assumption of the seller's $54 million loan with New York Life Insurance Company at a 3.5% fixed interest rate.

Key points:

1. The 238,747-square-foot shopping center, built in 2000, is located at 10604 Westview Parkway and is fully leased.

2. Major tenants include Home Depot, Smart & Final, CVS, Dave's Hot Chicken, Rubio's Baja Grill, Starbucks, Jersey Mike's, Verizon Wireless, PNC Bank, and a soon-to-be-built Lazy Dog restaurant.

3. Despite the property being zoned for mixed-use and allowing high-density housing, Decron plans to keep the center as a retail property.

4. This acquisition marks Decron's return to the retail sector after focusing primarily on residential properties since the Great Recession.

5. San Diego's retail sector is an attractive investment due to tight availability, with a current availability rate of 4.8% across the county.

6. Stockbridge Capital Group purchased the property in 2016 for $109.4 million as part of a larger transaction and is retaining the eastern portion of the center, where they are considering a mixed-use redevelopment.

Mira Mesa shopping center anchored by Home Depot sells for $99M - The San Diego Union-Tribune

A Los Angeles-based real estate firm that has spent the past 15 years focused on residential projects is re-entering the retail sector with the purchase of what is said to be an extremely healthy shopping center in Mira Mesa.

Thursday, Decron Properties announced that it

purchased the 238,747-square-foot Mira Mesa Market West shopping center

at 10604 Westview Parkway from Stockbridge Capital Group LLC for $99

million. Decron is a family owned mid Wilshire real estate developer. From the Decron website:

Decron was founded by Jack M. Nagel, a Polish-born Holocaust survivor who arrived in New York with no more than the shirt on his back. Through ingenuity, perseverance, and an unflappable spirit of positivity, he set to work, initially importing Swiss watches, and eventually moving to Los Angeles and diving headlong into construction and real estate development.

The off-market transaction, which involved seven parcels, included the assumption of the seller’s $54 million loan with New York Life Insurance Company. The inherited loan has a 3.5 percent fixed interest rate for the remaining loan term.

Although the 20.2-acre property is zoned for mixed use and allows for high-density housing, Decron intends to keep the center as is.

“Never say never about any opportunity, but right now, we have gone into this deal with the plan of keeping it a shopping center,” David Nagel, Decron’s president and CEO, told the Union-Tribune. “The business plan is to own the shopping center for many years and enjoy the tenancy that we have. It is 100 percent leased with tenants who are thriving, and we have no reason to want to redevelop this and repurpose it because the asset works.”

Built in 2000, Mira Mesa Market West is the western half of the large, outdoor shopping center along Mira Mesa Boulevard near Interstate 15. The property, just west of Westview Parkway, is anchored by Home Depot, Smart & Final and CVS. Other tenants include Dave’s Hot Chicken, Cold Stone Creamery, Rubio’s Baja Grill, Starbucks, Jersey Mike’s, Verizon Wireless and PNC Bank. A Lazy Dog restaurant is also in the works, with construction expected to begin in a couple of months.

The center saw nearly 6.9 million visits in the past 12 months, according to a news release announcing the sale.

Decron Properties, a family-owned real estate business, has 57 properties in California, Washington and Arizona, most of which are multifamily apartment buildings.

Prior to the Great Recession, the privately held firm’s portfolio also included a number of retail assets, but the company shifted to mostly residential assets — selling off all but three retail properties — to weather the financial turbulence of the period, Nagel said.

“(Our real estate adviser) kept reminding us over the last year or two, ‘Retail is back. Shopping centers are full. They’re staying full. Those guys that had financial issues, they’ve survived. Those that needed to right-size their portfolio because of online sales have figured that out now. And now it’s a healthy industry and you should consider going back into that business,’” Nagel said. “And this purchase represents our first purchase back into being a shopping center owner.”

San Diego’s retail sector is an attractive investment given tight availability in the market, said Joshua Ohl, senior director of market analytics for real estate tracker CoStar.

The availability rate for retail space across the county is 4.8 percent, he said.

“The availability rate has only increased by about 10 basis points in the past year. It’s still trending near the lowest level in more than 15 years,” Ohl said.

The sale price would be a net loss of $10 million, since Stockbridge Capital purchased Mira Mesa Market West for $109.4 million as part of a larger, $229 million transaction in June 2016 that included the sister Market East center, property records show.

Stockbridge Capital Group is a private-equity real estate investment company based in San Francisco, led by Terry Fancher and Sol Raso. Currently, the company has over $33 billion in assets under management.

Stockbridge Capital is retaining the eastern center — anchored by the Regal Edwards movie theater and home to Barnes & Noble and Old Navy — where the firm is contemplating a mixed-use redevelopment of the property, Nagel said.

“They’re using the equity that will come out of this sale to help them accomplish whatever that redevelopment will look like on the east portion,” he said. “Its underlining zoning is for high-density residential, and I think they’re continuing to pursue that. And we, of course, welcome that because we’ll have all these residents right across the street shopping in our shopping center.”

The newly adopted Mira Mesa Community Plan, approved in December 2022, seeks to boost the neighborhood’s population by transforming the area’s suburban strip malls, like Mira Mesa Market East and West, into urban villages. The mixed-use zone allows for up to 73 dwelling units per acre.

Los Angeles Firm Buys San Diego Shopping Center for $99 Million

City News Service

6/7/2024

Updated: 6/7/2024

Decron Properties Buys Mira Mesa Market West Shopping Center in San Diego for $99M

SAN DIEGO — Decron Properties has acquired Mira Mesa Market West Shopping Center in San Diego’s Mira Mesa submarket from Stockbridge Capital Group for $99 million.

The acquisition included the assumption of the existing financing with New York Life Insurance Co., which allowed for the assumption of a below-market interest rate of 3.5 percent fixed for the remaining loan term.

Built in 2000, the fully leased Mira Mesa Market West features 238,747 square feet of retail space. Current tenants include

- The Home Depot,

- Smart & Final,

- CVS/pharmacy,

- Dave’s Hot Chicken,

- Rubio’s Baja Grill,

- Starbucks Coffee,

- Jersey Mike’s Subs,

- Verizon Wireless,

- PNC and

- Lazy Dog restaurant.

The property is situated on 20.2 acres at 10604 Westview Parkway.

This is the first acquisition since 2008 for Decron, which owns and manages approximately 600,000 square feet of additional retail assets and nearly 10,000 multifamily units in California, Washington and Arizona.

City Council Updates Mira Mesa Community Plan, Adds Capacity for 24,000 Homes

The San Diego City Council Monday adopted an update for the Mira Mesa Community Plan, intended to serve as the framework for land use and urban design policies to guide neighborhood development over the next 20 to 30 years.

The update, which replaces the 1992 Mira Mesa Community Plan, expands the capacity for homes by 24,000 and adds the capacity for 5,000 jobs in areas near existing and planned high-frequency transit. With that added capacity, Mira Mesa will be able to accommodate 58,000 homes and 117,000 jobs in total, the plan reads.

“As one of San Diego’s largest communities by land area, population and employment, Mira Mesa will greatly benefit from having more mixed-used areas where people can live, work and play,” said Mayor Todd Gloria, whose office recommended the update. “In addition to helping achieve our Climate Action Plan goals, it also adds capacity for much-needed housing and encourages diversifying those homes for a variety of incomes and ages.”

The updated community plan encourages mixed-use development with pedestrian-friendly spaces and easy access to transit. It calls for bus flex lanes on Mira Mesa Boulevard and Miramar Road to alleviate congestion. Flex lanes are created by using the left or right shoulders of an existing roadway for temporary travel during certain hours of the day.

“As one of San Diego’s most diverse and popular neighborhoods, Mira Mesa is home to amazing businesses, shops and restaurants,” said City Councilman Chris Cate, who represents Mira Mesa. “This new community plan sets a vision for the next three decades that builds off the hard work and successes by community leaders who have made Mira Mesa what it is today.”

The plan also calls for a dedicated transitway along Carroll Canyon Road to accommodate express buses and an aerial skyway to connect the community to the Mid-Coast Trolley Extension, University City, UC San Diego and the San Diego Association of Government’s proposed commuter rail.

“Mira Mesa is a vibrant area, and we are thrilled to have a plan that creates a better balance of homes and jobs, with community infrastructure that will provide residents and workers with safe, convenient and enjoyable ways to travel,” said Heidi Vonblum, the city’s Planning Director. “More opportunities for homes and jobs in Mira Mesa is a win for our city and another step forward in achieving our housing and climate goals.”

Other highlights in the plan include identifying more than 91 lane miles of new bike facilities, proposing more than 100 acres of new parkland, 17 miles of trails, two new recreation centers and one new aquatic complex.

The city has completed 14 other community plan updates since 2015 and three more are in progress. The city’s planning department is also working on Plan Hillcrest, a focused amendment to the Uptown Community Plan.

City News Service contributed to this article.

Comments

Post a Comment